What is the morning star candle?

The morning star candlestick pattern is one of the bullish reversal patterns that usually appears at the end of the downtrend. Most probably, this pattern can be seen at the major support level.

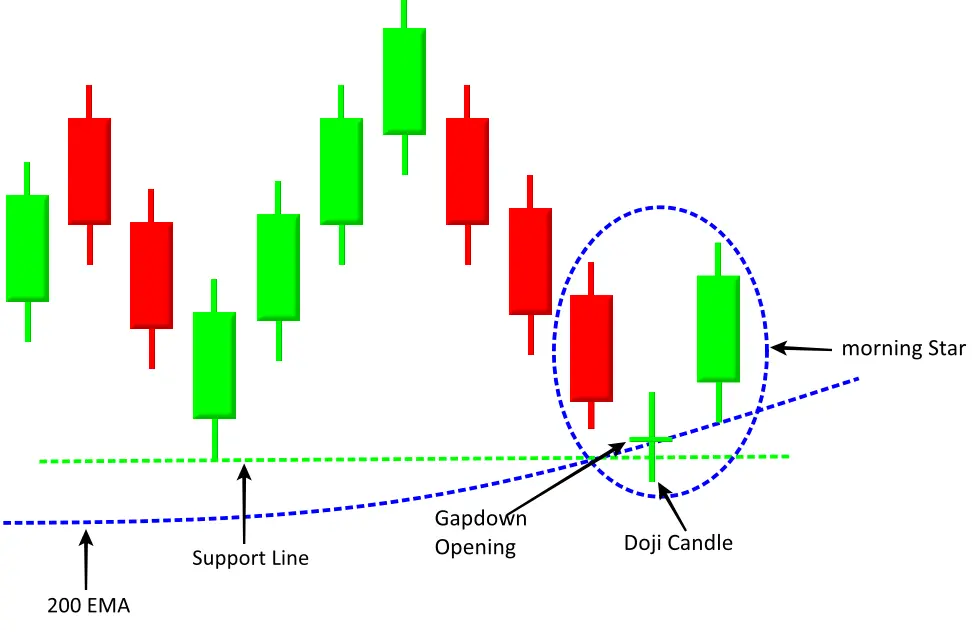

The morning star candlestick pattern is formed of three candles. The first candle is a red candle that indicates the continuation of the downtrend. When the price reaches the support level, sellers start squaring off their short positions. Some buyers are already at the support level but they fail to take the market higher and due to that the indecision doji candle is formed.

The third candle is a green candle indicates the buyers have entered the market and are ready to take the price higher. After seeing the morning star pattern, fresh buyers enter the market, and price starts going up.

The important thing is that the middle doji candle should be completely out of the first and third candle’s body.

How to trade the morning star candlestick pattern?

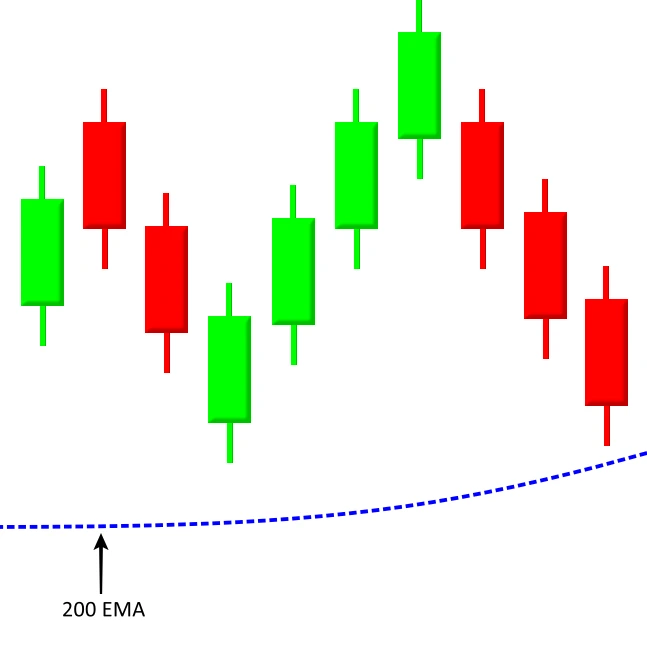

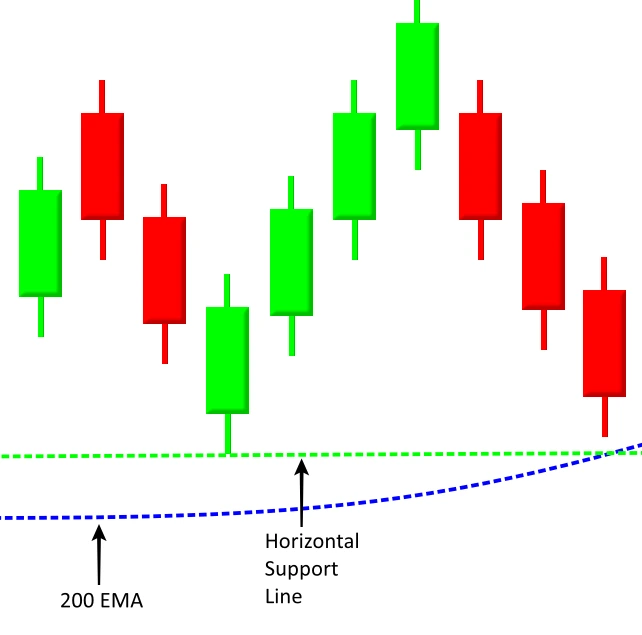

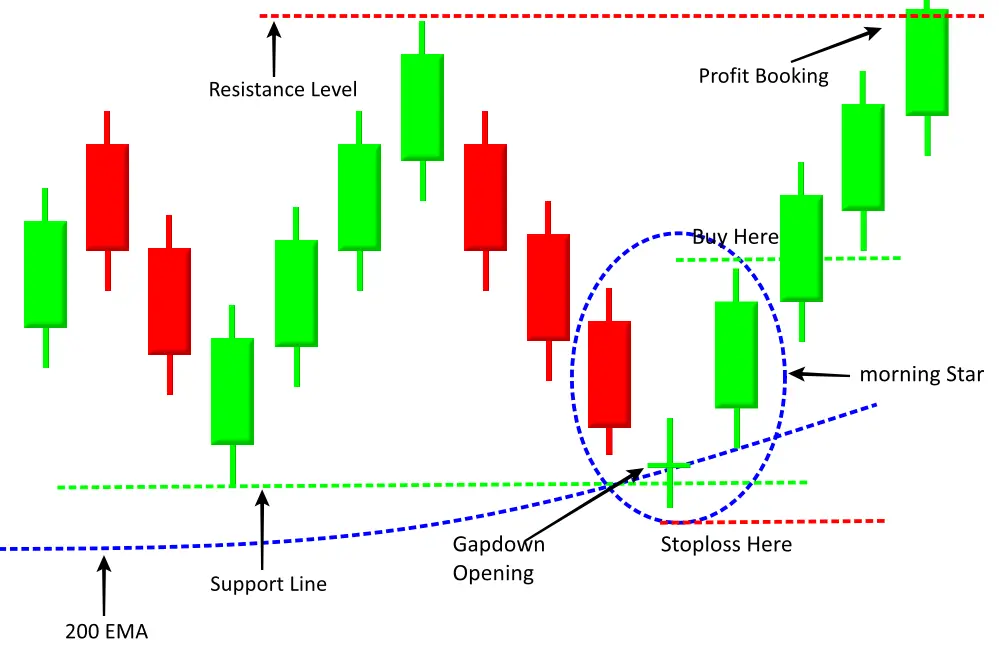

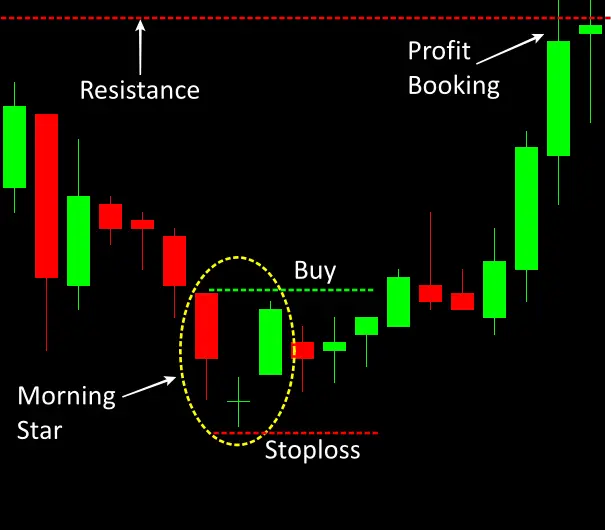

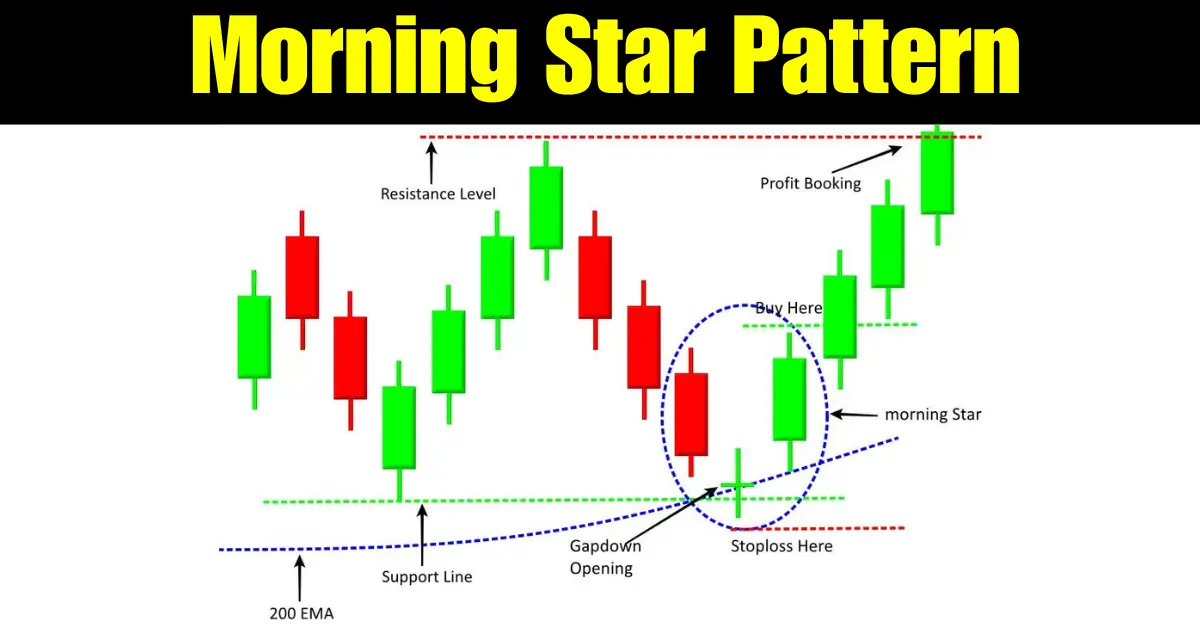

When the market is in an uptrend, it pulls back to the support level and starts going up again. If a morning star candlestick pattern appears at the support level, we should trade it. To determine the uptrend, we use the 200 EMA. We consider the uptrend when the market is trading above 200 EMA.

1.. The price should be trading above 200 EMA.

2. Wait for the price to come to the support level. The support level could be horizontal line support, trendline support, or dynamic support like 200 EMA or 50 EMA.

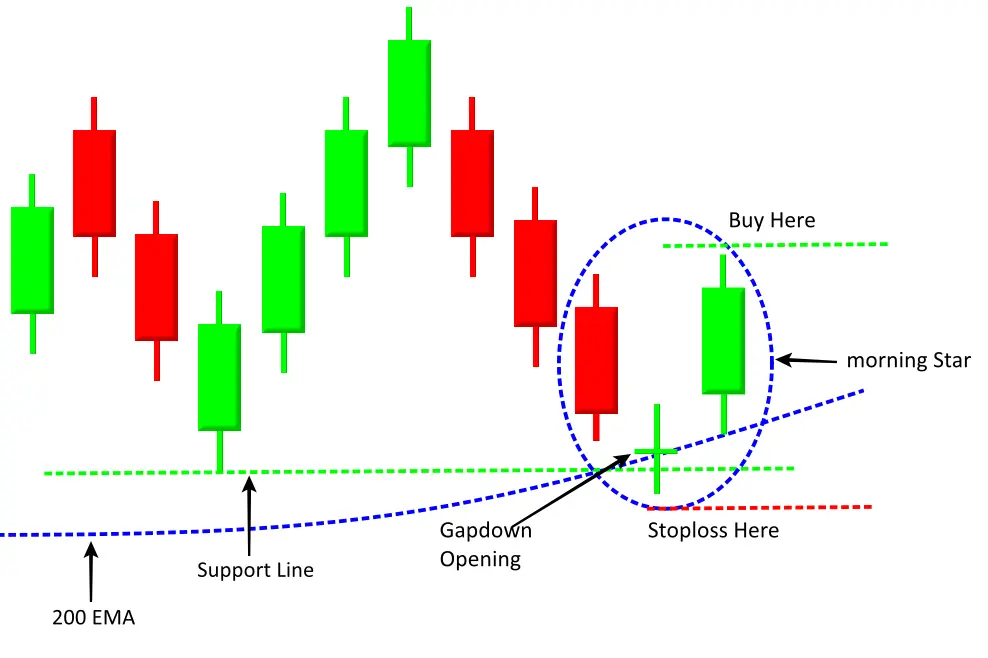

3. Wait for the morning start candlestick pattern to be formed. The first candle should be red. The second doji candle should open a gapdown. The third green candle should be strong enough.

4. The buy entry can be placed above the high of the highest candle among these three and the stoploss can be placed below the low of the lowest candle.

5. The profit can be booked at the next resistance level.

6. Here is the real chart example.

Important points to remember

- The price should be trading above 200 EMA.

- Wait for the price to come to the support level.

- Valid morning star pattern forms at the support level only.

- The first red candle should be strong enough.

- The second candle should be doji. The color of the doji candle doesn’t matter here.

- The third green candle should also be strange enough with maximum body and minimum wicks.

- The buy order can be placed above the high of the highest candle among these three.

- The stop loss can be placed below the low of the lowest candle among these three.

- The profit can be booked at the nearest major resistance level.

Also, Read about the Bullish Piercing Candlestick Pattern

FAQ – Morning star candlestick patterns

Q1. What is the morning star candle?

The morning star candlestick pattern is formed of three candles. It is the bullish reversal pattern. Usually, this pattern appears at the end of the downtrend. The first red candle indicates the trend continuation. The second doji candle opens a gapdown and indicates the indecision in the market. The Third green candle should be strong enough that indicates the strength of the buyers. The price goes higher after forming this pattern.

Q2. How to identify a morning star candle?

Just look for the Doji candle at the support level. If the Doji candle has opened a gapdown, then wait for the next candle to be formed. If the next candle is a strong green candle that opens gapup, then this is the morning star candlestick pattern.

1 thought on “Morning star candlestick pattern”