Best scalping strategy: Nowadays everybody needs money but people do not want to work hard. They always want easy money. There are some fields where you can earn lots of money with less effort and one of them is trading. people are earning good money in stock or Forex trading by spending just a couple of hours a day However it is not a cup of tea for everybody. you need to learn powerful strategies if you want to earn money from the stock market.

There are many ways to earn money from the stock market. Some people earn money from swing trading or some people earn money from intraday trading. Many of them are long-term investors as well. But believe me, the real money is hidden in the scalping and long-term Investments. Very few people are earning money from intraday trading and swing trading.

In this article, I will share my personal and secret scalping strategy with you guys so that you can earn at least 100 dollars from the stock/forex/crypto market.

I am going to apply this strategy in the forex market with a 15-minute time frame.

What are the prerequisites for this Scalping strategy?

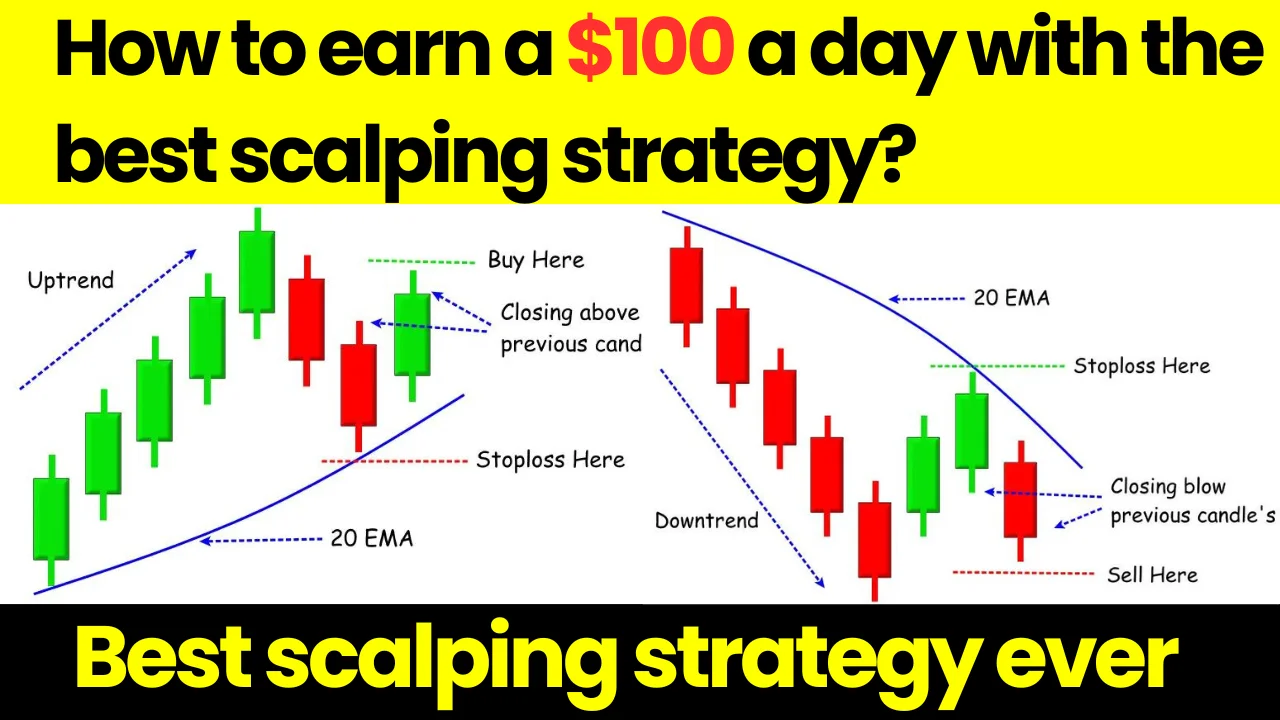

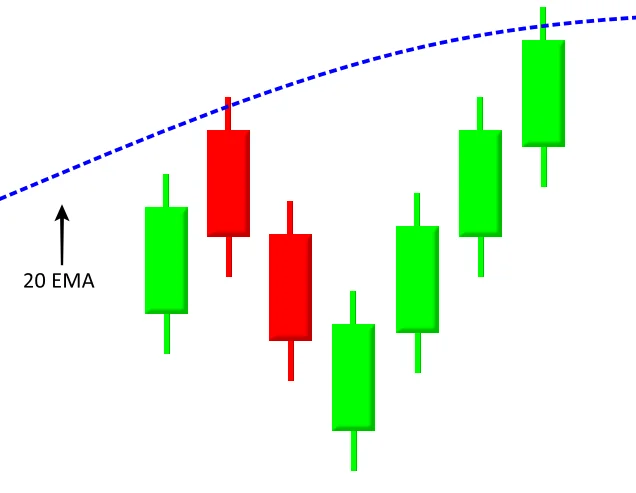

To make money in any market, it is very important to identify the current trend. If you can identify the trend correctly, you win 50% of the Battle. If you take the trade in the direction of the trend, your winning probability will increase drastically.

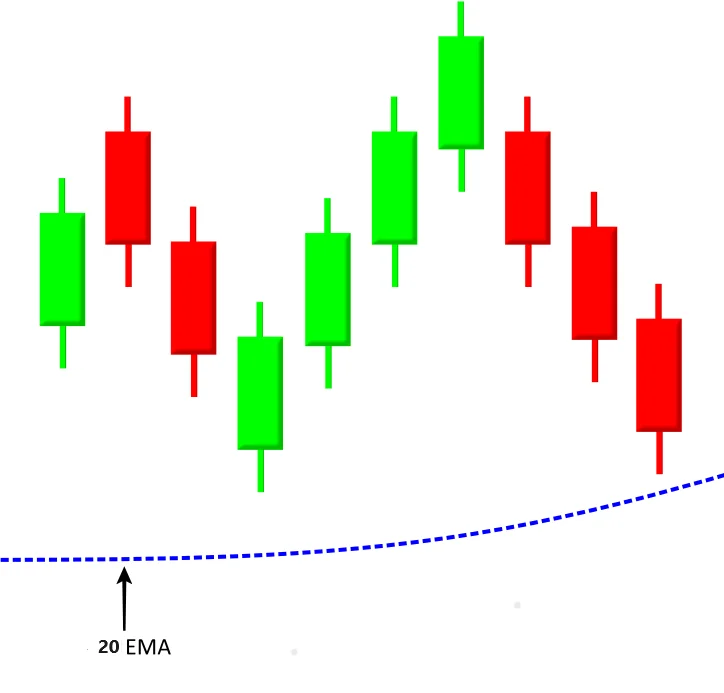

Now the question is, how to identify the trend? and the answer is very simple. There are two ways to identify the trend. the first one is the moving average and the second is the trend line. We are going to use the 20-period exponential moving average in this example however if you are familiar with drawing trend lines, you can use the same.

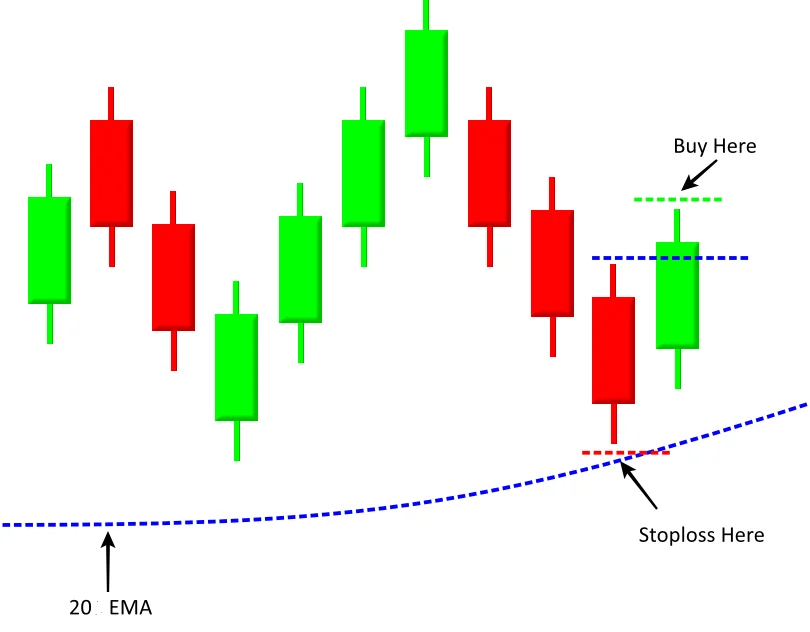

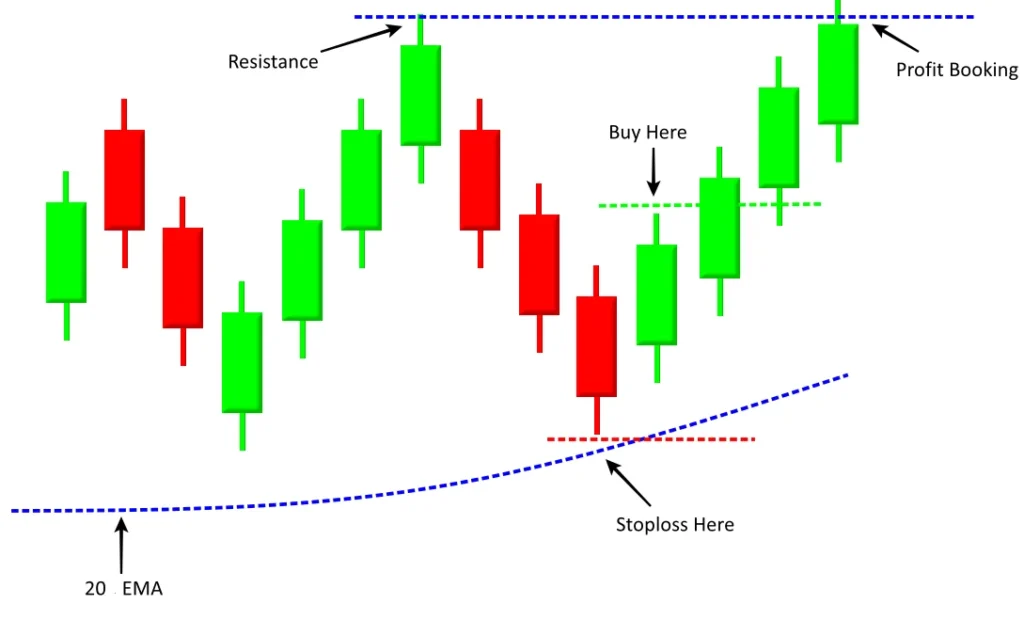

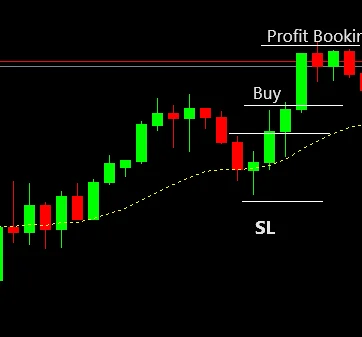

For buying

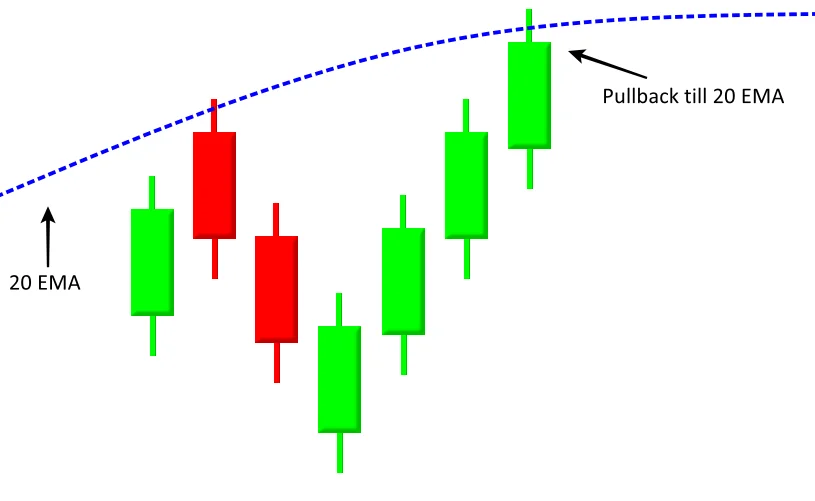

- Make sure the price is trading above the 20 EMA. Never buy when the price is trading below 20 EMA.

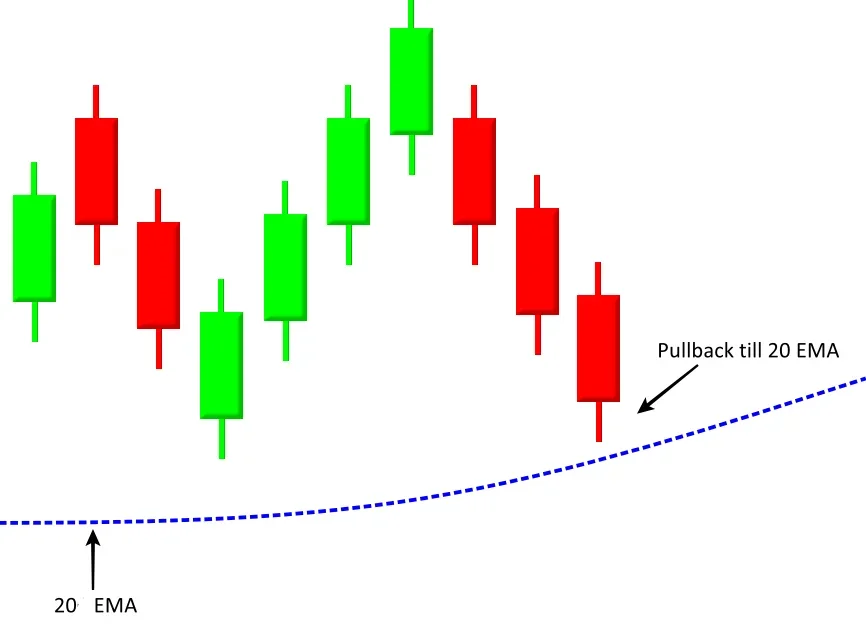

2. When the price is trading above the 20 EMA, wait for the pullback. Make sure the red candle is not closing below the 20 EMA.

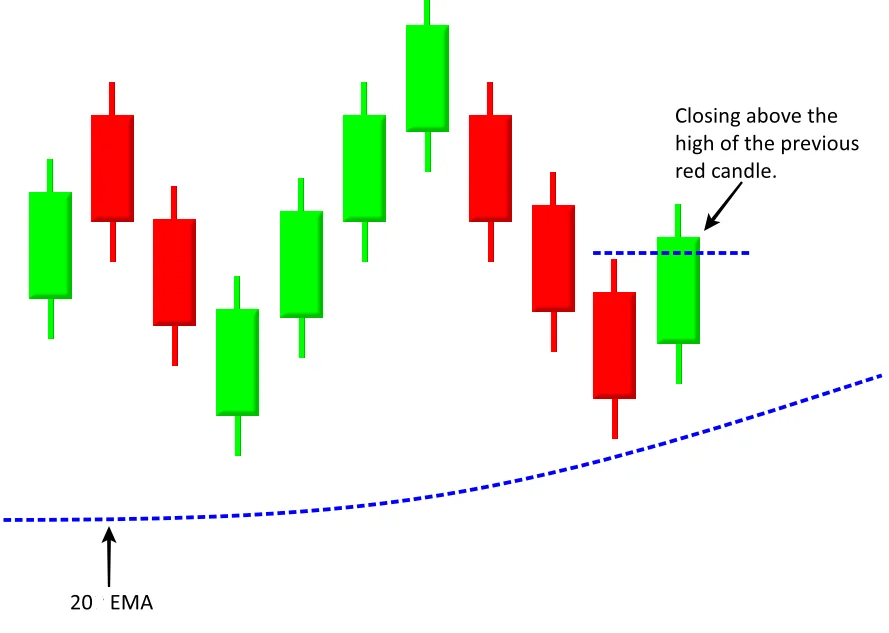

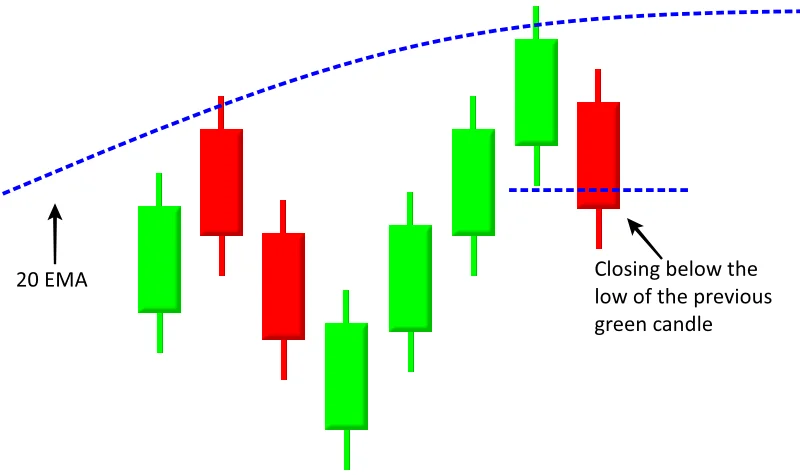

3. Now find one green candle that closes above the red candle’s high. The red and the green candle may or may not be successive. If they are not successive, you can consider the previous red candle.

4. Buy above the high of the green candle and place the stop loss below the low of the red candle.

5. Profit can be booked at the next resistance level.

6. Here is the real chart example.

For Short Selling

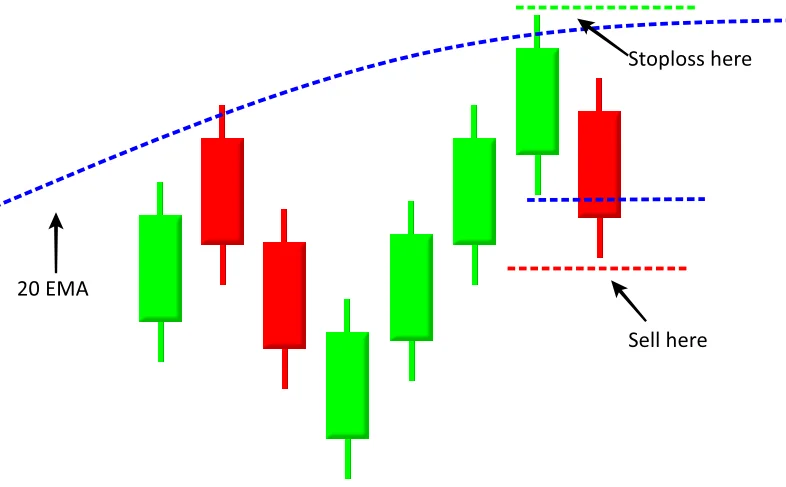

1. Make sure the price is trading below the 20 EMA. Never sell when the price is trading above 20 EMA.

2. When the price is trading below the 20 EMA, wait for the pullback. Make sure the green candle is not closing above the 20 EMA

3. Now find one red candle that closes below the green candle’s low. The green and the red candle may or may not be successive. If they are not successive, you can consider the previous green candle.

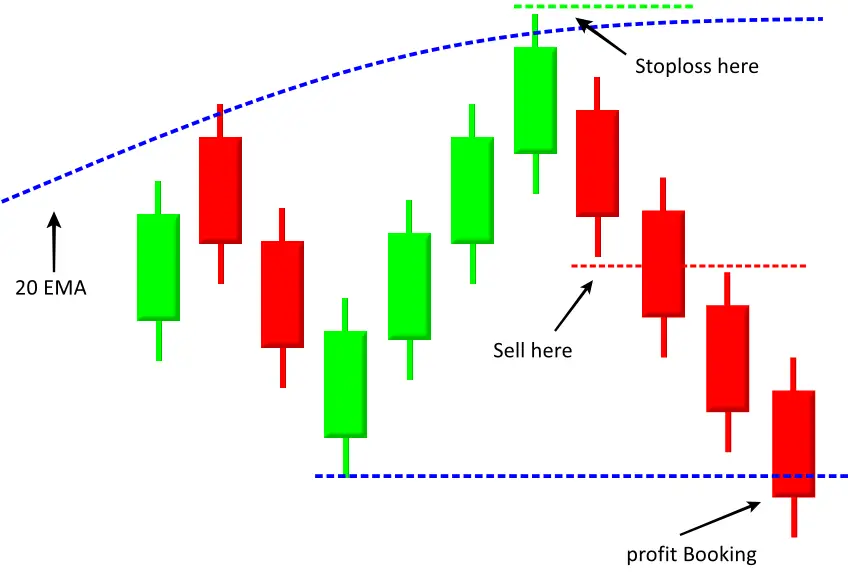

4. Sell below the low of the red candle and place the stop loss above the high of the green candle.

5. Profit can be booked at the next support level.

6. Here is the real chart example.

Conclusion: – why does this strategy work? If you observe it closely, you will notice that it is a breakout in a lower time frame and when the breakout happens, the market starts moving rapidly in the direction of the trend.

Just back-test this strategy and you will find that it is working almost every time.