This is not the gap-up or gap-down trading strategy that you are thinking of. This is a special strategy and if followed correctly you may earn huge money from the stock market. We named this strategy a Gap down reversal swing trading strategy as it works based on the gap-down candle.

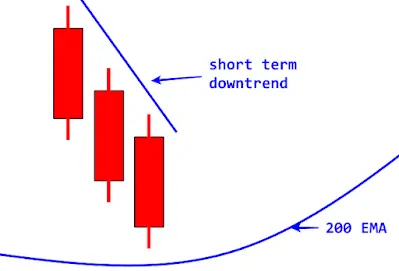

1.. It is very important to identify the trend first. You should always take the trade in the direction of the trend. Now the question is how can we identify the trend? The answer is 200 EMA. if the price is trading above 200 EMA we consider that trend is up and if the price is trading below 200 EMA we consider it a downtrend. To trade this strategy, the market should be above 200 EMA as shown in the below image.

2. Now uptrend is confirmed because the price is trading above the 200 EMA. The next step is to find at least 3 to 4 red candles which means we are searching for a pullback in an uptrend.

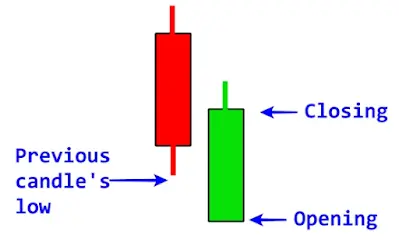

3. Find one green candle with a gap-down opening. It means the opening of the green candle should be lower than the previous candle’s low and the closing of the green candle should be higher than the previous red candle’s low. confused? The below image will clear things up for you.

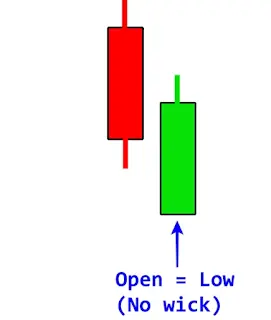

4. This step is the most important. The gap-down green candle should not have a lower shadow or wick it means the gap-down green candle should be open = low. It indicates that the market opened a gap down but the buyers were so strong that brought the market higher. You usually find this at the end of a short-term down trend where the trend reversal happens.

5. Now the question is where will you place your buy entry? and the answer is pretty simple. The buy entry should be placed above the high of the green candle. If buyers are so strong, then our entry will definitely get triggered and the price will go higher. But if buyers are not that strong then the price may not reach the high of the green candle and may start coming down so in that case our entry will not get executed. But usually, if we get the gapdown opening, the next candle forms higher than a previous green candle, and more and more buyers enter the market.

6. Another important thing is the stoploss. You can place your stoploss below the green candle but with a little bit of buffer. Sometimes small buffer plays an important role and it saves our order from hitting the stoploss. There is no thumb rule about the buffer but ideally, it should be at least 0.5% of the price

7. In any trading, the most important part is the profit booking. If you book your profit too early and exit from the trade, it is a kind of loss itself. It is very important to book the profit at a specific level where exit setup helps you. Now, what is the exit setup? Usually, if any red candle crosses its previous candle (it could be red or green) and closes below the low of the previous candle then we should book our profit.

The following figure illustrates this point very well.

8. I believe that every strategy is incomplete unless you see a screenshot from the real chart. Here is the real chart screenshot for you.

1 thought on “Gapdown reversal swing trading strategy | Forex Trading Strategies”