The breakout trading strategy is the most traded strategy in the world because it is very easy to identify and trade. But, most of the time when you take any breakout trade, the price starts coming down and hits your stop loss. If you are experiencing this situation again and again then you should not trade breakouts rather you should trade failed breakouts because the price goes up very quickly if any breakout fails.

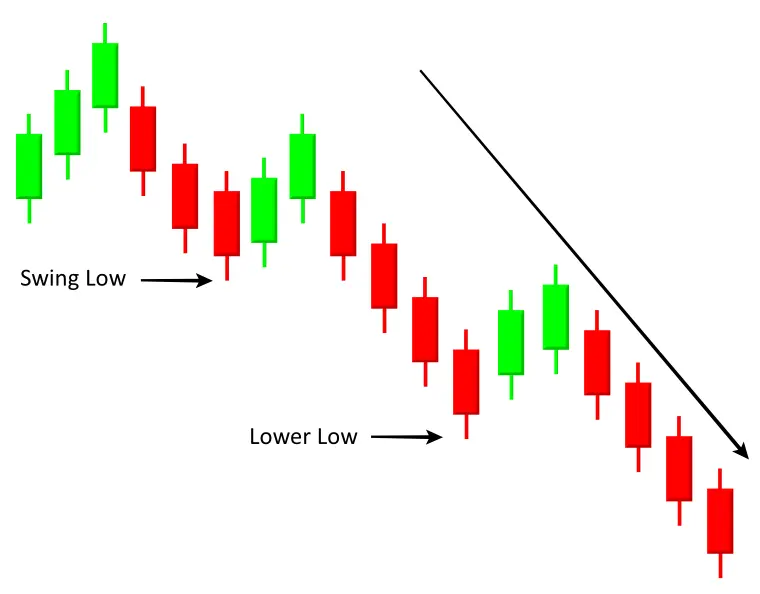

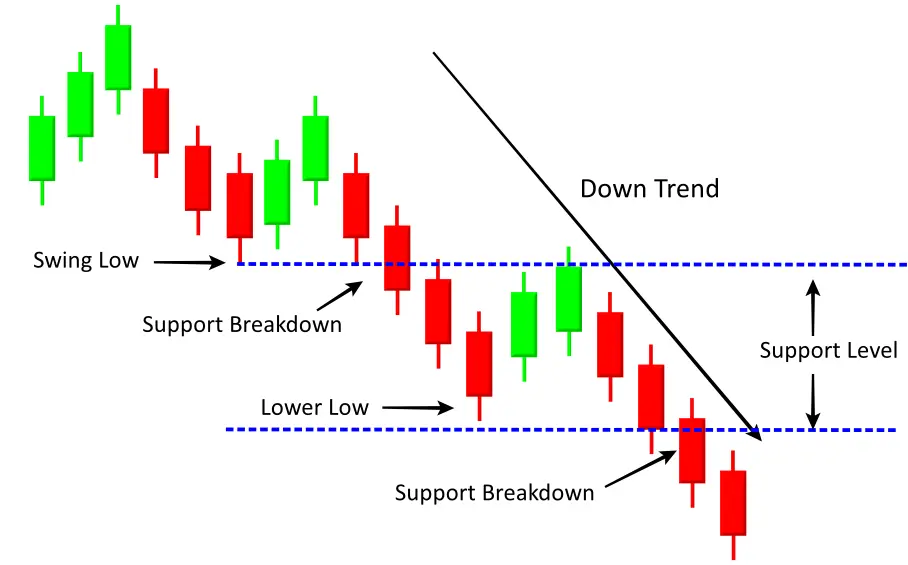

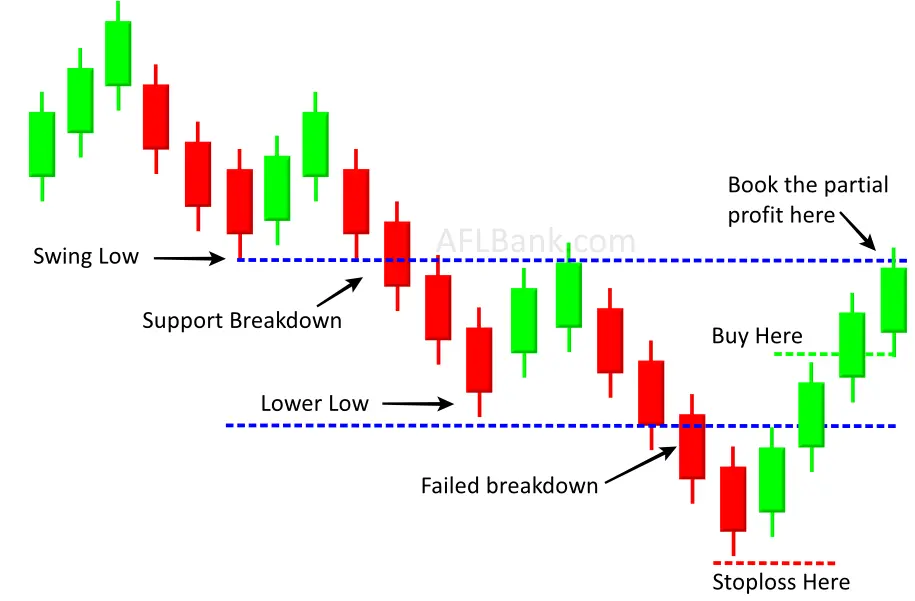

When the market comes down, it makes a lower low. When the market breaks any swing low, the sellers enter the market and take the price lower. If we draw the horizontal line below the swing low, we can call it a support line. sometimes market goes up to retest the breakdown level and then starts coming down.

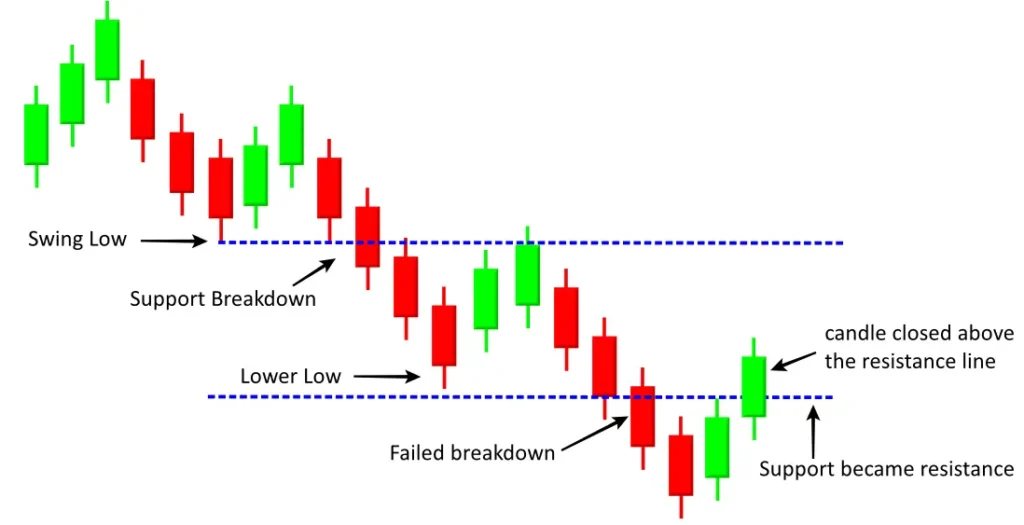

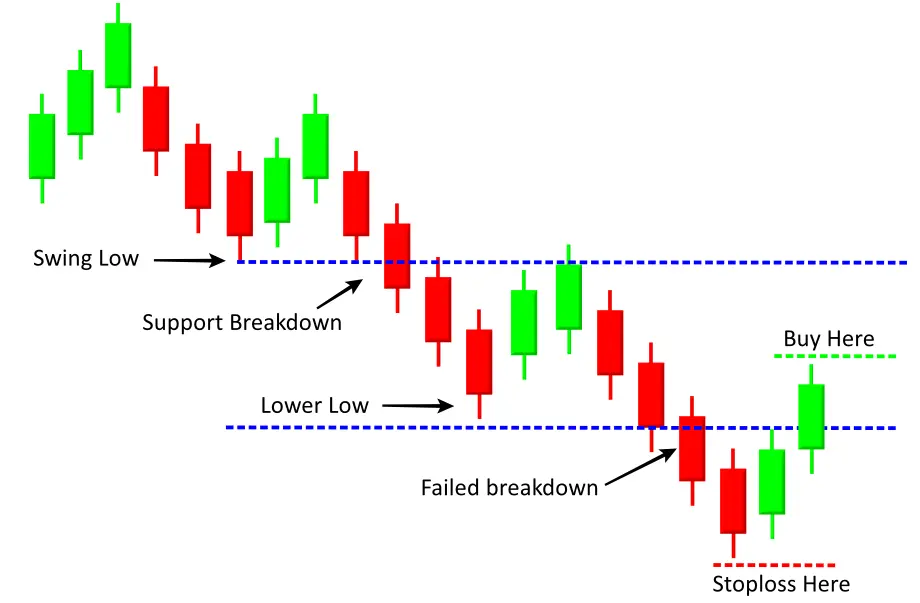

When any strong green candle closes above the support line or breakdown level, we call it a failed breakdown and you may get a great opportunity to buy the market. When there is any failed breakdown in the market, it hits the stop loss of existing sellers and starts going up very quickly by making long green body candles.

This strategy is purely based on price action. We are not going to use any indicator.

This strategy can be used in any market in any time frame. For forex traders, we recommend a 1-hour or 4 hours time frame.

How to trade the failed breakout trading strategy for buying?

1.. If there is a downtrend in the market, just notice how the market is coming down by making lower lows.

2. If you draw the horizontal lines below the swing low, they are called the support levels. When any support level is broken, the market comes down very quickly because after breaking the support levels, many sellers enter the market and take the price down.

3. After multiple lower low formations, sellers start losing control and the downtrend becomes weaker and weaker. Then buyers enter the market and start taking control. If the strength of the buyers is enough, they are able to break the resistance level (Wich was the support level previously) and a green candle closes above the resistance level.

4. In addition you can check the volume of the green candle. If volumes are higher than the volumes of a previous couple of candles then that is the additional confirmation. Now place the buy entry above the high of the green breakout candle and place the stop loss below the swing low.

5. The most important is profit booking. This could be the exact reversal point of the market so you can expect a decent profit at least 1:4. If the next resistance level is not too far then either avoid that trade or square off 50% of position at that resistance level. The. The remaining 50% quantity can be squared off at the next resistance level.

Failed breakout trading strategy (short selling)

The failed breakout trading strategy works great in short selling compared to buying.

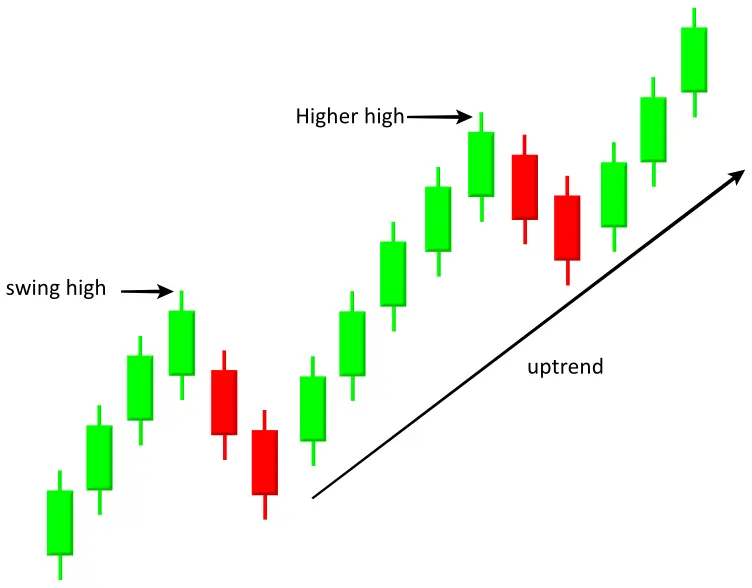

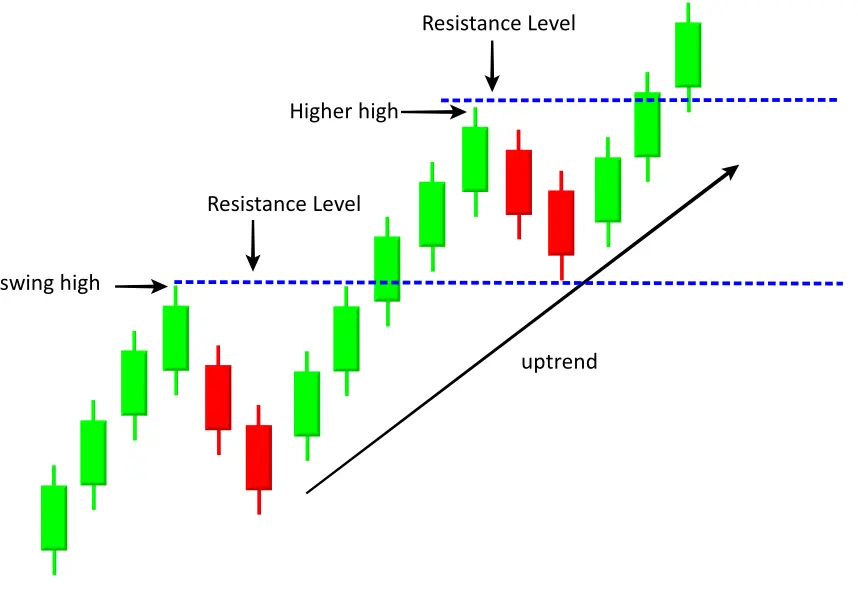

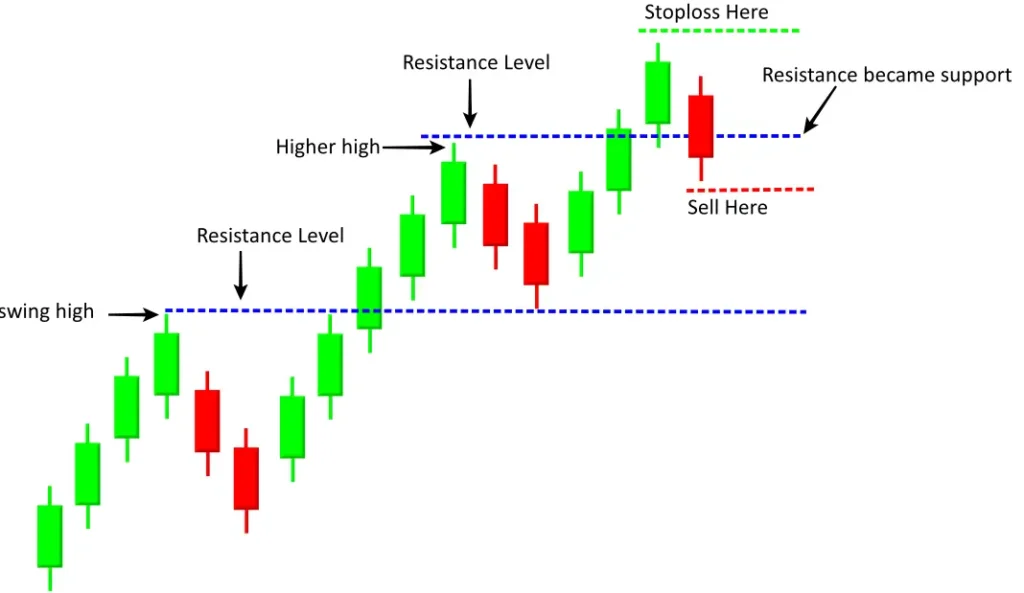

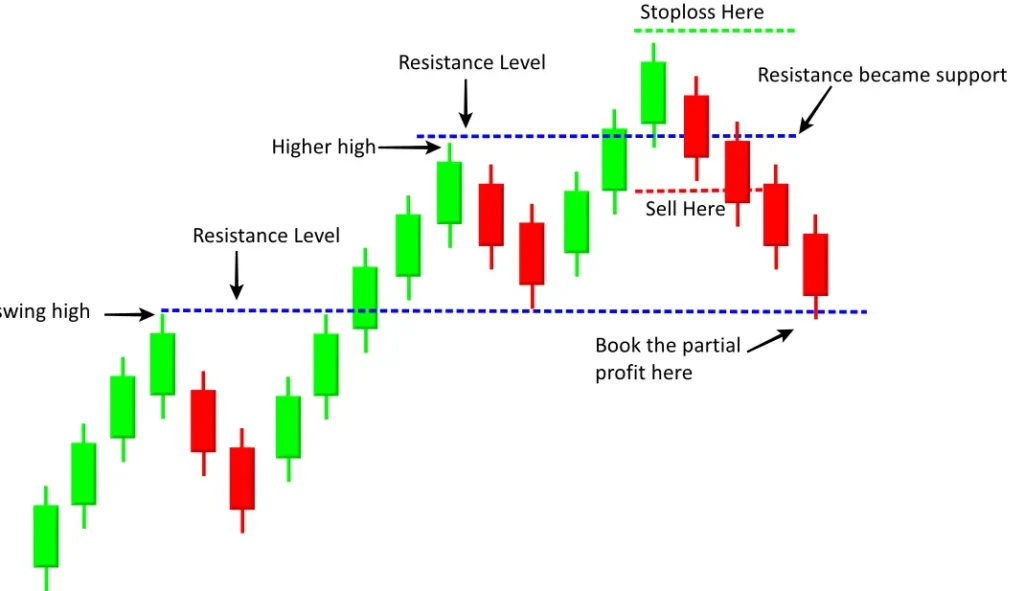

When the market is in an uptrend, it goes up by making a higher high. When there is any swing high breakout, buyers enter the market and take the price higher. If we draw the horizontal line on the swing high point, we call it a resistance level.

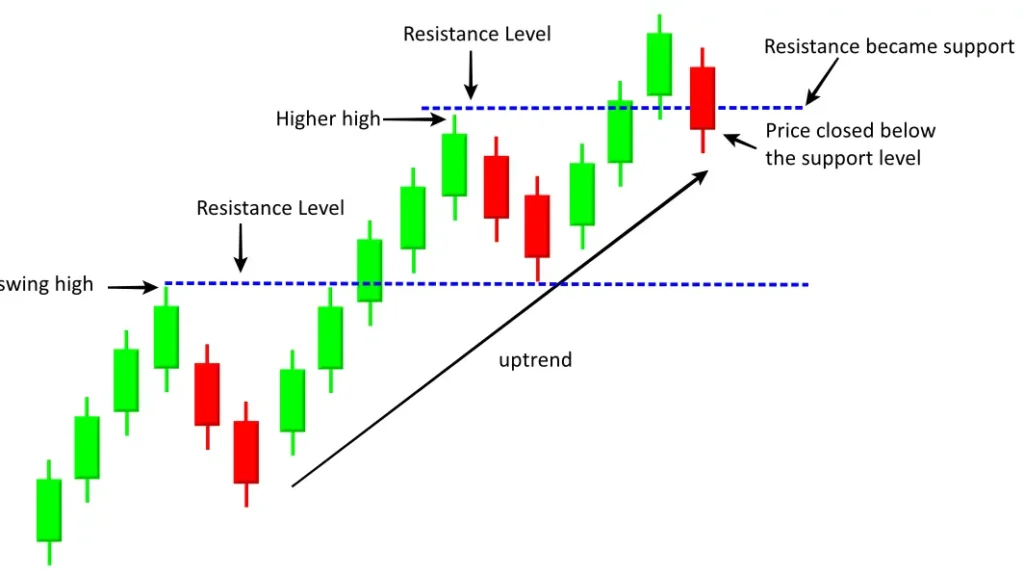

Sometimes, when the market breaks the resistance level, it starts coming down instead of going up. If any red candle closes below the resistance level, we call it a failed breakout. Price comes down very quickly when a breakout fails.

If we are able to identify the failed breakout correctly, we can earn a lot of money in the forex or any market. This strategy is purely based on price action. We are not going to use any indicator in this strategy.

This strategy works in any market and in any time frame but for the forex market, it is recommended to use 1 hr or 4 hr time frame.

How to trade the failed breakout trading strategy for short selling?

1.. When there is an uptrend in the market, the market goes up by making a higher high

2. If you draw the horizontal lines above the swing high, they are called resistance levels. When the price breaks any resistance level, we call it a breakout. Whenever the price breaks out, many new sellers enter the market and take the price higher.

3. After multiple higher high formations, buyers start losing control and the uptrend becomes weaker and weaker. If any red candle closes below the resistance line, we call it a failed breakout. Whenever there is failed breakout, buyers square off their positions and new sellers enter the market and take the price down.

4. If the volumes of the breakdown red candle are higher than the volume of a previous couple of candles, it is considered as an additional confirmation. The sell entry can be placed below the low of the red breakdown candle. The stop loss should be placed above the swing high only.

5. The partial profit can be booked at the next support level and be in the trade. Complete position can be squared off at the next to next support level.

2 thoughts on “Failed breakout trading strategy | Forex trading strategies”